How To Create

A Custom CSV File

Instructions

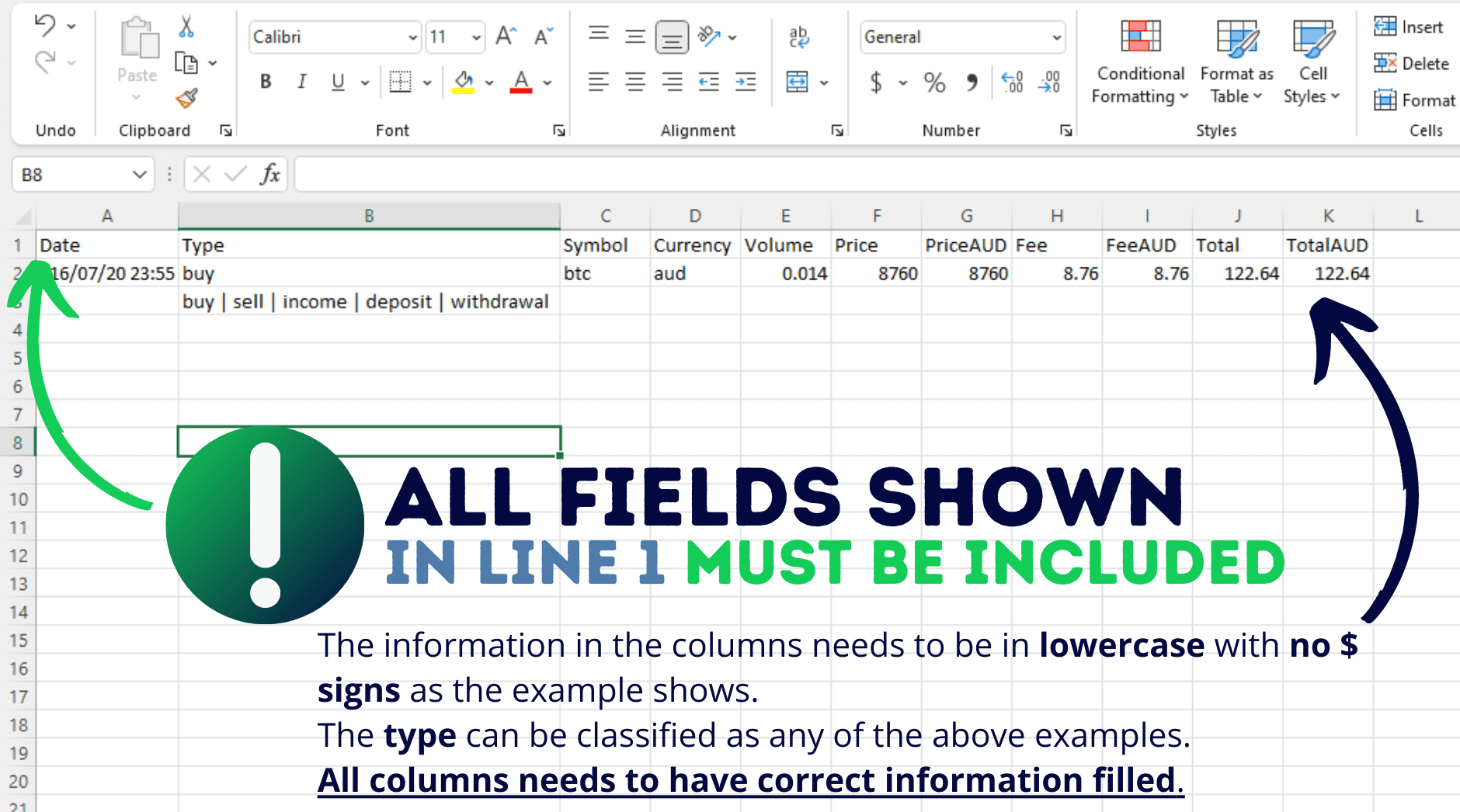

View the Universal Format below and cross reference this with the example image provided.

Create a new Excel document and copy all of the fields shown below and in the example image.

When you have finished entering all of your data into the Excel document, click on File > Download > Comma-separated values (CSV) to download the file and import it into Crypto Tax Calculator Australia’s application.

Universal Format

This format can be used for importing any kind of data. You have to specify and fill in all required fields for the Universal Format CSV file to provide an accurate tax report.

Required fields:

Date, Type, Symbol, Currency, Volume, Price, PriceAUD, Fee, FeeAUD, Total, TotalAUD

Column Descriptions:

Where there are bold values they are the value for the column (capital letters are for emphasis only, all values need to be lowercase):

· Date: The date of the transaction.

· Type: Transaction Type, can only be from the following types:

- Did you buy: The taxable acquisition of an asset is when you get the asset and have to pay taxes on it, used to establish the cost base. (e.g. Buying 1 BTC with AUD)

- Did you sell: Taxable disposal of an asset is when you sell an asset that you have to pay taxes on (e.g. Selling 1 BTC for AUD)

- Is it income: Ordinary earnings, such as staking/airdrops. (e.g. Received 0.01 BNB airdrop)

- Is it a deposit: Non-taxable acquisition of an asset such as a transfer in from a wallet to the exchange, this will be ignored for tax purposes (e.g. Transferred 1 BTC from a separate wallet)

- Is it a withdrawal: Non-taxable disposal of an asset like a transfer out of the exchange to a wallet, this will be ignored for tax purposes (e.g. Transferred 1 BTC to another wallet)

· Symbol: The coin being traded (e.g. btc or eth)

· Currency: Currency used for the trade, could be aud or another coin (e.g. Bought BTC with aud, or sold btc for eth)

· Volume: Amount of the transaction (e.g. Bought 25 ETH for AUD)

· Price: Value of the symbol (coin) in the listed currency (e.g. $8765 AUD)

· PriceAUD: Value of the symbol (coin) converted to AUD (e.g. $8765 AUD = $8765 AUD)

· Fee: Transaction fee charged in the listed currency

· FeeAUD: Transaction fee charged, converted to AUD

· Total: Total transaction value in listed currency (Volume x Price = ______)

· TotalAUD: Total transaction value converted to AUD (Volume x Price = ______AUD)