Crypto Tax Calculator Australia is not affiliated with any other service using a similar name. We are independently Australian-owned and operated.

Crypto Tax Calculator Australia

Easily sort out your crypto tax today

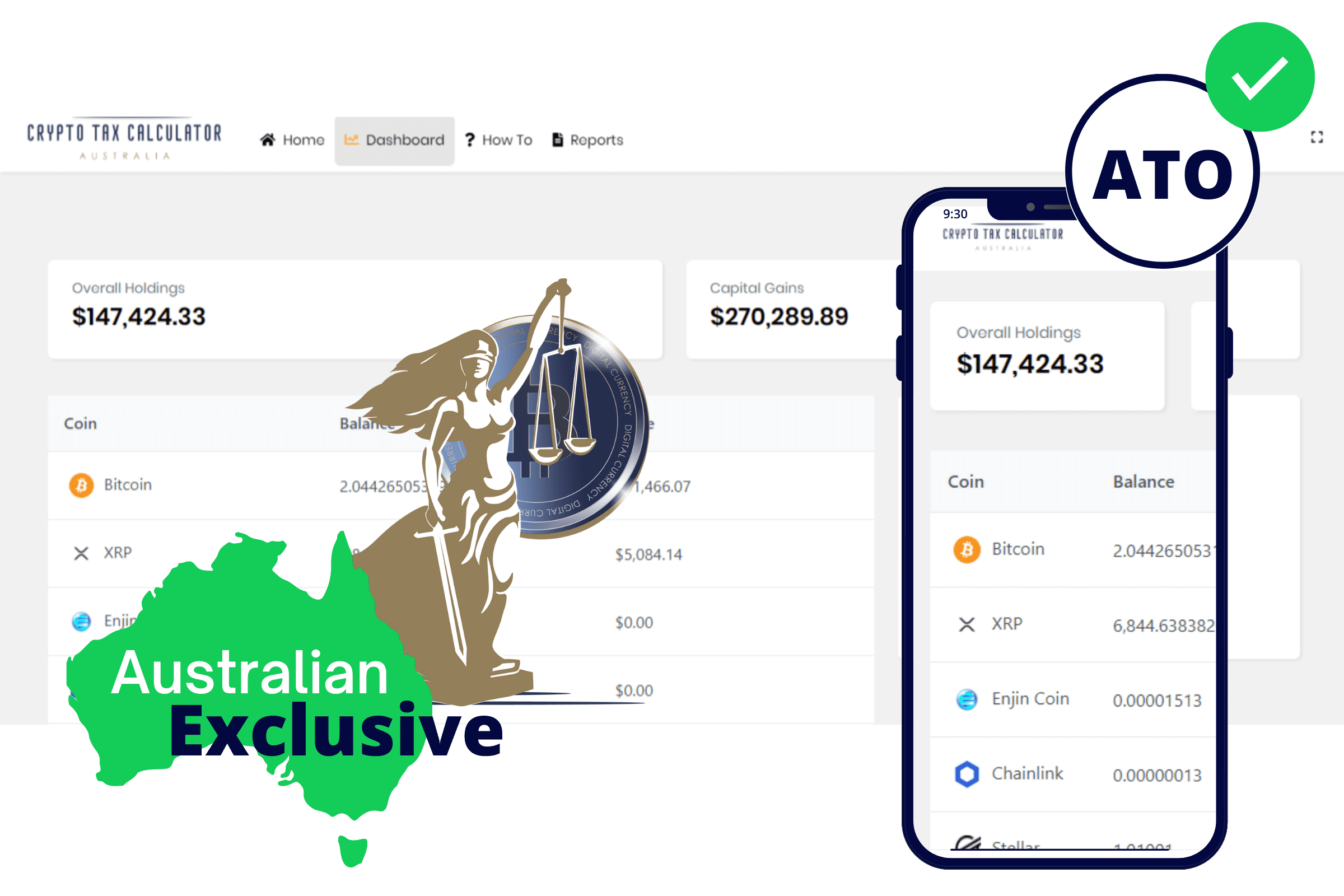

ATO Tax Reports in Under 10 mins

Our Australian crypto tax calculator is the perfect tool whether you are a beginner trader or an experienced crypto king. Import your cryptocurrency data and calculate your capital gain taxes in Australia instantly!

- Free report preview

- ATO ready tax reports

- Supports DeFi & DEX trading

Accountant Approved

We help provide detailed and accurate reports for accountants and their clients. If you’re an accountant, please contact us to learn more about our accountant partnerships and pricing.

Data Privacy

We strongly believe in data protection and privacy. We do not keep your crypto data, we do not store crypto data on any servers and any CSV file uploaded is used for calculations and then deleted.

Simple Calculations

We show each calculation so you can understand how your taxes were calculated and which regulations have been utilized. These calculations are simple, visible and accurate.

ATO Ready Tax Reports

Our crypto tax application helps you calculate your taxes. We do this with accuracy. We look at things like DeFi loans, DEX transactions, coin to coin trades and leveraged trading.

Complete your crypto tax calculations in 3 easy steps

1. Obtain your crypto data

WE DON'T KEEP YOUR DATA

At Crypto Tax Calculator Australia, we support and strongly believe in customer privacy. Therefore our crypto tax application does not store or keep your crypto data.

You simply review your crypto transactions that you wish to export from your current exchange (e.g BTC Markets) and export this data as a CSV file which is then saved to your device.

2. Upload to our crypto tax calculator

UTILISE OUR UNIQUE ALGORITHM

After obtaining your CSV file and crypto data, you login to your account with us at Crypto Tax Calculator Australia and upload your CSV file.

Our unique algorithm will easily calculate your complex crypto taxes, proliferate your unique dashboard to track your coins and gains and also generate your crypto tax report within seconds.

3. Generate your crypto tax report

MULTIPLE REPORTS FOR ANY FINANCIAL YEAR

Our crypto tax application supports multiple exchange uploads combined into one easy to read tax report. As well as the ability to generate multiple reports for previous financial years at no extra cost.

Crypto Tax Calculator Plans

We have a variety of personal plans and pricing to help you calculate your crypto tax for any financial year you need. Our plans and pricing are focused on affordability and cost less per year than most streaming services like Netflix or Disney+

For more information on our different pricing, check out our simple affordable plans

Basic

$49

/year

For the beginner or basic trader. If you only have one exchange that you use, you need this plan.

Advanced

$99

/year

For the experienced crypto trader. If you use multiple exchanges you need this plan.

Trader

$249

/year

For the daily crypto trader. If you use multiple exchanges and mass amounts of trades you need this plan.

FREE Trial

$0

A little taste of the best crypto tax calculator application in Australia!

How is crypto tax calculated?

Depending on your individual circumstances, you can sometimes be liable for both capital gains and income tax depending on your crypto transaction. For example, making profits from buying and selling cryptocurrency will mean you need to pay capital gains tax. Plus earning interest when you hold crypto will mean you may need to be pay income tax.

How can Crypto Tax Calculator Australia help me with crypto taxes?

You just need to import your transaction history and we will help you calculate your realised capital gains and current holdings. You can then send this to your accountant or tax agent and keep detailed records handy for audit purposes.

Can’t I just get my accountant to do this for me?

We always recommend you work with your accountant/tax agent to review your records. However manually preparing your transactions and books can be extremely time consuming, and most accountants will just use software such as CryptoTaxCalculatorAustralia to do this, possibly charging a large sum.

Can I use my own accountant?

Yes you can, CryptoTaxCalculatorAustralia is designed to generate easy tax reports. You simply import all your transaction history and export your report. This means you can get your tax details up to date yourself, allowing you to save significant time, and reduce the bill charged by your accountant or tax agent. You can discuss tax scenarios with your tax agent and have them review the report we provide.

Summ vs Crypto Tax Calculator Australia

Crypto Tax Calculator Australia vs Summ A factual comparison for Australian crypto investors If you’re searching for a crypto tax calculator in Australia, you may

Is There A Tax On Transferring Crypto Between My Own Wallets?

Is There A Tax On Transferring Crypto Between Your Own Wallets? Transferring cryptocurrency between wallets you own is generally not taxed in Australia, because it

What Are The Pros And Cons Of Owning Cryptocurrency?

What Are The Pros And Cons Of Owning Cryptocurrency? Owning cryptocurrency offers high potential returns and increased financial control, but it also comes with significant

Crypto Tax Calculator Australia

Help & support

At Crypto Tax Calculator Australia we strongly believe in ensuring you have a seamless and easy process using our application.

That is why we have created a number of articles to assist you in getting started with our crypto tax calculator along with a dedicated email for support. You can view our crypto tax useful articles or contact one of the team on support@cryptotaxcalculatoraustralia.com.au

If you are ready to move forward and get your crypto tax in Australia sorted, you can sign up here today!